🙏🏼 A mindful guide to volatile markets

🙏��🏼 A mindful guide to volatile markets

Watching the markets dip is never easy. Even for the most seasoned investors, seeing red on your dashboard can trigger a very real sense of unease.

Your first instinct, to protect what you’ve built, is completely natural. It’s human nature to want to "do something" to make that feeling go away.

However, some of the most challenging moments in the market are also where the most important progress is made. We’ve found that the best way to navigate these periods isn't to ignore your feelings, but to give them a framework.

Before you make a move, take a breath and walk through these three questions with us.

🥅 1. Has my goal changed, or just the price?

We know that everyone’s "Why" is different.

Maybe you’re building a safety net for your family, or perhaps you’re finally starting that long-term wealth journey. These aren't just numbers; they are your plans for the future.

Prices move at the speed of light, but your life goals usually move much more slowly. If you were investing for a future three or five years away, that timeline likely hasn't shifted just because the market had a rough week.

We understand: It’s hard to stay focused on a 5-year goal when the 5-minute chart looks stressful.

The Calm Question: ✅ Am I reacting to a temporary number, or has my personal situation actually changed?

If your goal is still the same, reacting to a short-term price swing might create more stress rather than "managing" it.

📈 ❤️ 2. Am I acting on information or emotion?

Volatility is an emotional amplifier. It turns "what if" thinking into "must act now" urgency. We’ve all been there; it’s an uncomfortable place to be.

But it’s important to remember that these feelings often peak after a market move has already happened. Deciding while your heart rate is up usually means you’re reacting to how you felt ten minutes ago, rather than planning for where you want to be ten months from now.

We understand: Fear is a powerful motivator, but it’s rarely a good financial advisor.

The Calm Question: ✅ Would I be making this same decision if the market were steady today? If the answer is "no," it might be time to step away from the screen for 48 hours.

Pausing isn’t always straightforward & personal circumstance is always a factor. Sometimes (if those circumstances allow), the most productive thing you can do for your portfolio is to close the app and go for a walk.

🌱 3. What is the hidden cost of "doing something"?

In most areas of life, action is rewarded. In investing, the opposite is often true.

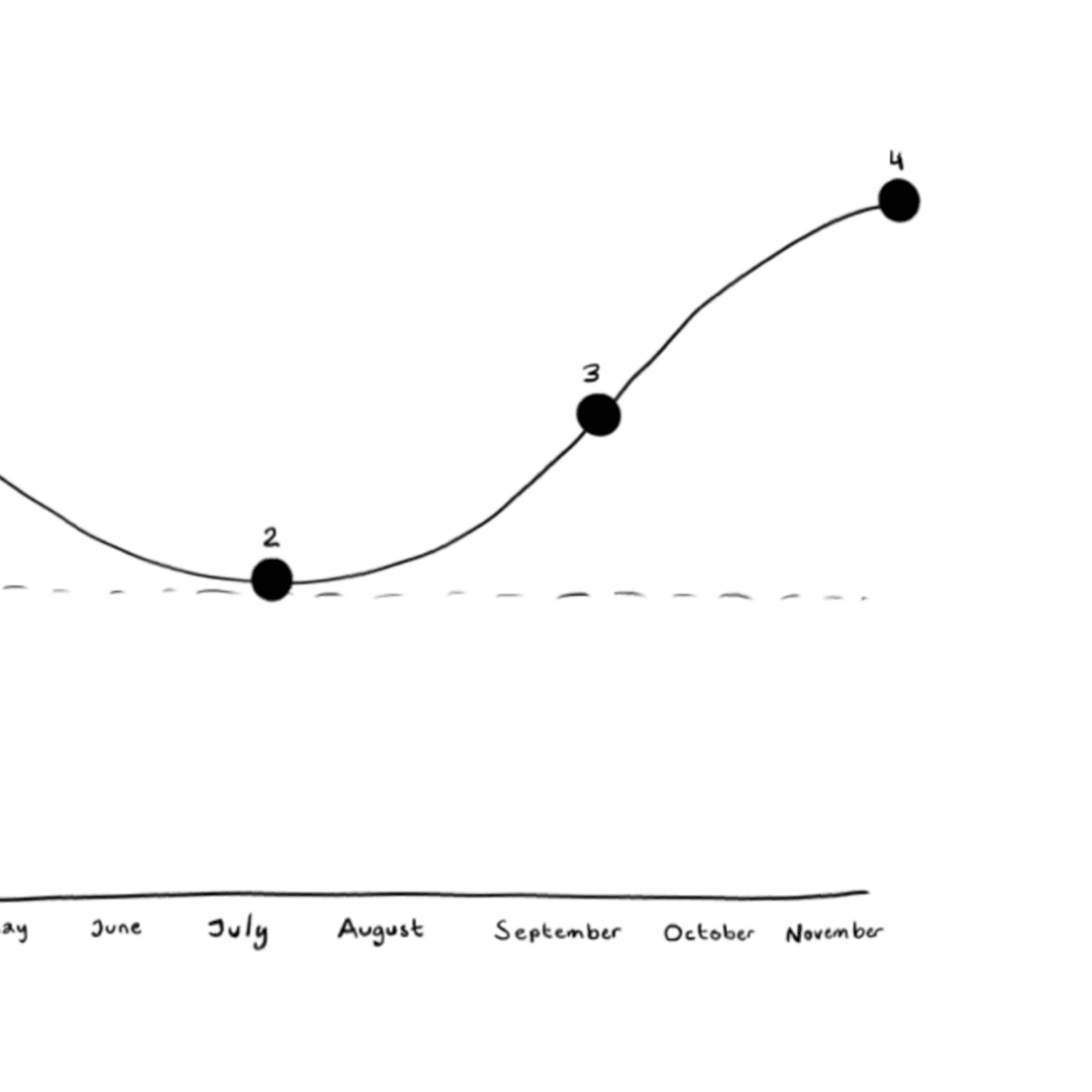

We understand the temptation to "sell now and buy back later," but that often creates hidden hurdles. You might miss the recovery, break your compounding momentum, or dial back your dollar cost averaging strategy unnecessarily.

Remember, healthy financial habits take time to build but can be broken very quickly.

We understand: Doing nothing feels passive and being passive feels risky when things are moving fast.

The Calm Question: ✅ Is the temporary "relief" of selling right now worth the potential growth I might miss when the market recovers?

Often, staying "boring" is the ultimate edge.

🏎️ The Bottom Line

It’s okay to feel uneasy. We built Bamboo to help make these moments easier to manage through automation, but the human element is always there.

Having a calm framework to consider isn't to turn you into a robot; it's to help you build a habit that is stronger than a bad day in the markets.

Check your spread, remember your "Why," and remember that we’re in this for the long haul together.

Team Bamboo 🌱

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter